by Michele | Apr 17, 2013 | Preparation Stage

Everything you need to know about cruising is in here!

So far in our month of finance posts, we’ve gone over our savings goals and reducing our current spending. But of course all of this is meaningless unless we have a plan for how much we will be spending while we cruise. People have asked this question on every blog and every forum available to cruisers of all levels and with something as individual as personal spending it is a fairly difficult question to answer. The most common response is “it costs whatever you have” or “that’s the same thing as asking how much it costs to live on land…its all up to you.”

While I appreciate the idea behind the answer, I also think that there is a way to generalize expenses for people. I can tell you that it is possible to live on $750/month or less for a couple in my town if you rent or own a one bedroom shack, eat peanut butter sandwiches every day and don’t own a car or have other insurance. You could spend $2000/month living in a small 3 bedroom home, eating good meals at home, driving one car rarely and being otherwise frugal. Or you spend $5000/month on a nice home in a good neighborhood, drive expensive cars that get terrible gas mileage as much as you want, and eat out for every single meal to normal restaurants. I can’t tell you how much it would cost your family, but I can give you the basis to help you figure it out on your own.

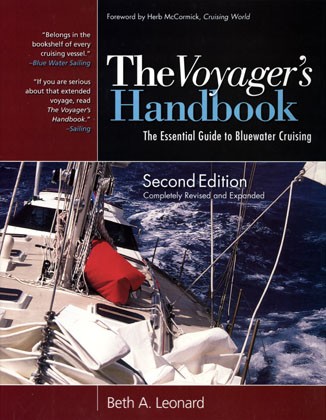

That’s exactly what Beth Leonard has done in this fantastic article entitled “How Much Will Cruising Cost You?” and also in her book The Voyager’s Handbook. She details the spending habits of three fictional cruising families: the Simplicity’s in a 33 ft cutter, the Moderation’s in a 40 ft catamaran, and the Highlife’s in a 54 ft ketch. In my opinion, this is the best document on cruising budgets that I have found in any of my research, and is what Dan and I based many of our calculations on when trying to figure out how much we would need monthly and yearly to live at the level we desired. We believe that we can budget somewhere between the Simplicity spending of 8,000/year and the Moderation level of 20,000/year leaving at somewhere in the $1000-$1500 per month range. This budget was also verified by a seminar called Three Cruising Budgets given by George Day of Blue Water Sailing magazine at Strictly Sail Chicago this year.

Obviously, we don’t know for certain yet how much we will spend once we start sailing, but it is important for us to have some sense of direction to work with while planning. No one else will have the same budget as us (and certainly not one man on a forum that told us we would need at least $50,000/year…he and his wife spent $1500/month on food alone!) but we think that using a generalized picture has given us pretty realistic expectations. We’re always open for comments or suggestions, so leave one for us below!

by Dan | Mar 27, 2013 | Preparation Stage

Our first step was selling both of our Saab 9-3s

When we talk with people about cruising the first question people usually ask us, after getting over their disbelief, is “How are you going to pay for it?” In the spirit of tax season, we’ve decided to do a short mini-series in April devoted to finances, both for cruising and anyone trying to get a little more bang for their buck.

Have you ever looked at someone in a luxury motorized throne (ok, imported luxury vehicle) and thought, “Wow, sweet ride! I wish I was wealthy enough to have one.” Okay probably not in those words… but the reality (according to the authors of The Millionaire Next Door, two PhDs with over 20 years of research on the subject) is that most people living in affluent neighborhoods and driving luxury vehicles actually don’t have very much wealth. Sure they can afford the payments on their McMansions and land yachts, but many of them are living paycheck to paycheck. They are constantly teetering on the edge of financial ruin, saving less than a few percent (if at all!). Sadly, retirement is only a pipe dream to many people from all levels of the tax bracket. They think about in abstract terms, hopefully they’ll have enough to retire at some distant point in the future… definitely not something attainable in the near term.

However, with the right approach retirement is not only attainable, it’s attainable in a relatively short amount of time. Michele and I are recently followers of Mr. Money Mustache, who retired a few years ago at age 30. He explains it best:

Mr. Money Mustache’s advice? Almost all of [the life is hard and expensive excuse] is nonsense: Your current middle-class life is an Exploding Volcano of Wastefulness, and by learning to see the truth in this statement, you will easily be able to cut your expenses in half – leaving you saving half of your income. Or two thirds, or more. Sound like a fantasy? Not to readers of this blog.

What happens when you can save more of your income? As it turns out, spending much less than you earn this is the way to get rich. The ONLY way. And the effects are surprising: if you can save 50% of your take-home pay starting at age 20, you’ll be wealthy enough to retire by age 37. If you already save some assets now, you’re even closer than that. If you can save 75%, your working career is only 7 years.

But how can you save so much?

The bottom line is this: by focusing on happiness itself, you can lead a much better life than those who focus on convenience, luxury, and following the lead of the financially illiterate herd that is the TV-ad-absorbing Middle Class of the United States today (and most of the other rich countries). Happiness comes from many sources, but none of these sources involve car or purse upgrades. No matter what the herd or the TV set tells you, this is the truth. Far from being a social outcast, this new perspective will make you a hero among your friends. This is not a fringe activity anymore – millions of people are fixing their lives these days. And the earlier you can accept it, the sooner you will be rich.

It is not an easy journey to begin, but it is a path that leads to what I call time freedom. Time freedom doesn’t necessarily mean sitting on a beach somewhere doing nothing all day, every day. It simply means having the freedom to spend your time the way you wish. Michele and I have been blessed with a great starting point on our journey. We were able to very quickly build and capitalize on equity in our first home. We’ve been able to turn that into a portfolio of rental homes (we close on our third next week!) and traditional investments. These properties and other investments will provide a decent income when we retire. More importantly, we’re learning to live on much less than our current income while maintaining an extremely high quality of life, which is precisely what we are expecting to continue doing when we go cruising.

We are normal (well ok, not so normal) people that have a dream to see the world and live life as it was meant to be. We both have successful careers in the healthcare industry, even in this terrible economy. We want to break free of the current cycle of trading time for dollars and dollars for more and more things we don't need. So, we have decided to forego the fruits of our economic success and "retire" well before we are 30 and set out to see what is over the Horizon.

We are normal (well ok, not so normal) people that have a dream to see the world and live life as it was meant to be. We both have successful careers in the healthcare industry, even in this terrible economy. We want to break free of the current cycle of trading time for dollars and dollars for more and more things we don't need. So, we have decided to forego the fruits of our economic success and "retire" well before we are 30 and set out to see what is over the Horizon.